Selecting the right company structure for your business is important as any other business-related activity. The right business structure will allow you to effectively manage your enterprise and accomplish your desired business goals. In India, every business must register itself as part of the mandatory legal compliance. It is important to choose the structure of your business carefully as your income tax return will depend on it. Simply stated when registering your enterprise through online company registration in Chennai-T.Nagar, remember that each business constitution has different compliance that must be met. For example, the sole owner only has to file an income tax return. However, the company has to file an annual return with the income tax return to the Registrar of Companies.

The books of the company’s accounts have compulsorily date every year. To make a point, it is important to choose the right business structure when considering company registration. The entrepreneur should have a clear idea of what kind of transaction he is willing to do for legal compliance.

While some business structures are relatively investor-friendly than others, investors will always prefer a valid and legal business structure. For example, the investor would be reluctant to give money to the sole owner. On the other hand, investors will be more comfortable investing if a good business idea supports a valid legal framework (such as an LLP, company, etc.).

Documents required for online company registration

Address proof

- Passport

- Election card or voter identity card

- Ration card

- Driving permission

- Company incorporation in Chennai needs Electricity bill

- Telephone bill

- Aadhar card

- Bank statement

Residential proof

- Electricity bill

- Telephone bill

- Mobile bill

Foreign Director

- Driving permission

- Residence card

- Bank statement

- The government issued an identity card with the address.

Residential proof

- Bank statement

- Electricity bill

- Telephone bill

- Mobile bill

Additionally the following also required as proof of registered office:

- Authorization of the landlord (electricity bill or gas bill or water bill or name mentioned in the receipt of property tax or sale deed), to have usage by the company as a fee to use the place.

- This is commonly referring to as the homeowner’s NOC; and On the other hand, evidence of any utility service such as telephone, gas, electricity, etc., showing the address of the place in the name of the owner or document, which is not more than two months old.

Shareholder: Indian National or Foreign National

Proof of identity and address, as detailed in the article, must have submission to all shareholders of the company (i.e., Memorandum Association of Association (MOA)) and Articles Association of Association (AOA) subscribers.

Shareholder: A corporate entity or artificial judicial person

- If the MOA and AOA are a single shareholder or a corporate entity (company, LLP, etc.) from the customer, the bill must have attachment to the resolution passed by the corporate to subscribe by body corporate.

- In addition to the above evidence and documents, many documents such as INC-9, MOA, AOA will be prepared by a professional. These legal documents must have signature and notarized by the promoters of the company specifically designed for investment.

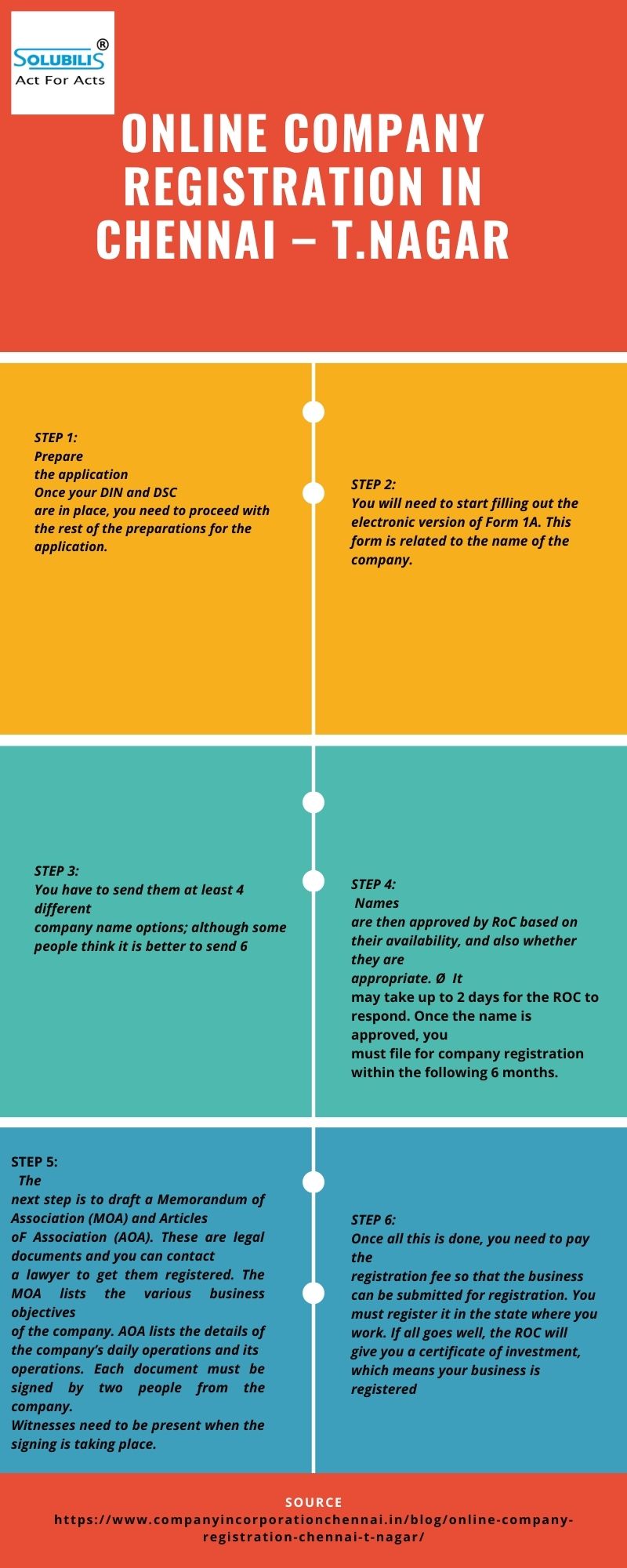

Online procedure for registration

Prepare the application for company incorporation in Chennai. Once your DIN and DSC are in place, you need to proceed with the rest of the preparations for the application. You will need to start filling out the electronic version of Form 1A. This form is related to the name of the company. You have to send them at least 4 different company name options; although some people think it is better to send 6. Names are then approved by RoC based on their availability, and also whether they are appropriate. It may take up to 2 days for the ROC to respond. Once the name has approval, you must file for company registration within the following 6 months.

Draft MOA and AOA

The next step is to draft a Memorandum of Association (MOA) and Articles of Association (AOA). These are legal documents and you can contact a lawyer to get them registered. The MOA lists the various business objectives of the company. AOA lists the details of the company’s daily operations and its operations. Each document must be signed by two people from the company. Witnesses need to be present when the signing is taking place.

When these documents are created, you have to send them to the ROC so that they can inspect them. It allows ROC documents, and then you need to print them so you can notarize them. Once that is done, you can file them with the rest of the documents that are required to register your business.

Once all this is done, you need to pay the registration fee so that the business can be submitted for registration. You must register it in the state where you work. If all goes well, the ROC will give you a certificate of investment, which means your business is registered. Once that is done, you can start running your business.

Once your business is registered, you must take a few additional steps. You will have to file for GST number

Benefits

What’s more, there are numerous benefits in Company incorporation in Chennai. They are: Company has

Separate legal entity: In the eyes of the law, the company is separate from the owners of the company, which means that the company exists by the rule of law and can end with the power of law. Not related to the lives of company owners. So no doubt about it!! Owners may exit, but the company lasts forever.

Free transfer of ownership: In case of ownership, there is no option to transfer all the documents related to the business and occupation to another person as all the registration is with the name of the owner of the paid firm. But in the case of a company it is very easy to transfer the shares of the company, and the person who owns the shares of the company is the real owner of that company.

Company Limited Liability: Owners have unlimited liability in every business type (except LLP). In the event that there is any damage to the business, the owners there are also liable to pay damages to an outsider of the business from personal property. But in the case of the company there is no such rule.