The matter of a sole proprietorship known as by various names e.g., Sole ownership, singular ownership, single business, and so forth It is the most seasoned, the least complex and the most widely recognized type of business association. Sole proprietorship business has its formation, financed, possessed and oversaw by a solitary individual. The proprietor bears every one of the dangers and gets the whole benefits of his business.

Sole proprietor business is a sort of specialty unit where one individual is exclusively liable for giving the capital, for bearing the danger of the endeavor and for the administration of business. Under the sole proprietor type of possession, a solitary individual sorts out and works the business in his own name. He isn’t just liable for its administration yet in addition for its dangers.

Sole proprietor is a type of business where the individual ownership is the preeminent adjudicator of all issue relating to his business. Sole proprietor acts as a casual sort of business claimed by one individual.

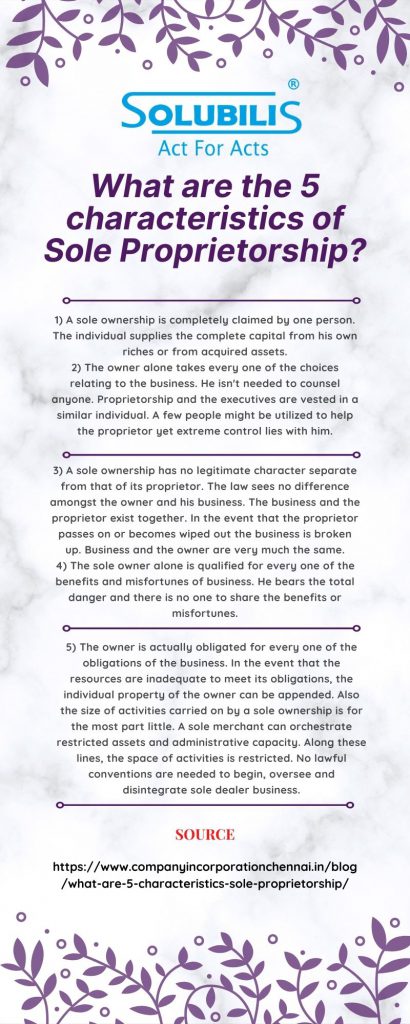

Characteristics of sole proprietorship

Single ownership

A sole ownership has its claim completely by one person. The individual supplies the complete capital from his own riches or from acquired assets.

One man’s administration

The owner alone takes every one of the choices relating to the business. There is no need to counsel anyone. Proprietorship and the executives have vested in a similar individual. A few people might have utilization to help the proprietor yet extreme control lies with him.

No legal entity

A sole proprietorship has no legitimate character separate from that of its proprietor. The law sees no difference amongst the owner and his business. The business and the proprietor exist together. In the event that the proprietor passes on or becomes wiped out the business is broken up. Business and the owner are very much the same.

Sharing of the profit

The sole owner alone is qualified for every one of the benefits and misfortunes of business. He bears the total danger and there is no one to share the benefits or misfortunes.

Unlimited liability

The owner actually has the obligation for every one of the obligations of the business. In the event that the resources are inadequate to meet its obligations, the individual property of the owner can be appended.

Also the size of activities carried on by a sole ownership is for the most part little. A sole merchant can orchestrate restricted assets and administrative capacity. Along these lines, the space of activities have restriction. No lawful conventions are needed to begin, oversee and disintegrate sole dealer business.

Formation of sole proprietorship

Any individual can begin a business at whatever point and any place he prefers. Notwithstanding, the sole broker should have an individual skill to go into an agreement. The business to have continuation should have permission by law.

Sometimes, a permit from the equipped specialists might have requirement for beginning the business. For instance, an individual burning of beginning a scientific expert shop is necessary to get a permit from the nearby Government.

The primary choice associated with the arrangement of sole proprietor business is the choice of a specific line of business. This choice relies on the interest capability of a product, the accessibility of important assets and the extent of procuring benefits. The choice of an appropriate site is another significant choice. The prerequisites of clients and the closeness to the market ought to have the thought of. The size and size of tasks have likewise to be thought of. Sole proprietor business can be shut whenever without lawful conventions. The owner has basically to settle the cases of his leasers and end up the business.

Areas of application of sole proprietorship

A sole trading concern is a type of business association, which has the claim and overseen by a solitary individual. It has no legitimate personality separate from that of its proprietors. The arrangement of sole proprietorship is simple and includes less lawful conventions. Any individual who has the skilled can set up his own business.

A sole proprietorship is by and large appropriate for a business

a) Where capital required is generally less.

b) Where speedy choice can be taken.

c) Where the danger implied is extensively less.

d) Where restricted administrative expertise takes place.

e) Where closeness with clients and laborers is fundamental.

Disadvantages of sole proprietorship

Acting naturally utilized in a sole ownership frequently implies having no workers or accomplices to examine business issues, investigate novel thoughts, or associate with on a social premise. Other huge disadvantages include:

- No legal separation

- Exposure to liability

- Business pay revealed as personal income

- Trouble getting contracts

- Difficult to sell the organization

With a sole proprietorship, there is no legal separation among you and the business, so if the business comes up short and causes obligations, your own resources—including your home and some other resources enrolled in your name—could have seized to release the liabilities (which can be limitless). Moreover, in the event that you have sued for harms brought about unintentionally or carelessness in your business exercises, your own resources can likewise have seized.

Tax

While tax simplicity can be a benefit for sole ownerships, it can likewise be an inconvenience as far as adaptability since all business pay should be accounted for ordinary pay in the year it was procured. Incorporated organizations have significantly more adaptability as far as how and when the proprietors have paid.

A few organizations and government offices won’t manage unincorporated organizations since they see a sole ownership as not having a similar degree of authenticity and polished methodology as a joined business. Numerous additionally accept a sole owner expands the danger of the duty specialists regarding the individual as a representative instead of a self- employed entity.

Sole ownerships can likewise be hard to sell in light of the fact that the business has attachment totally to the proprietor. Since there is no qualification between the resources of the proprietor and the business’ resources, the appropriate valuation of the business can be difficult to accomplish. Activity astute, except if the sole owner has companions or relatives who can continue maintaining the business, disease, or injury can influence business progression. Client steadfastness lives with the first proprietor of the business and may not promptly move to another proprietor.