A private limited company defined as a secretly held business element. It always held by private partners. The obligation course of action in a private restricted organization is that of a restricted association, wherein the risk of an investor stretches out simply up to the quantity of offers held by them. The investors have no risk past the estimation of the offers. The administering body for such an organization is the Ministry of Corporate Affairs (MCA).

Segment 2 (68) of the Companies Act, 2013 characterizes a privately owned business as:

“A Company having a base settled up share capital as might have recommendation, and which by its articles,— (I) confines the option to move its offers; (ii) besides if there should arise an occurrence of One Person Company, restricts the quantity of its individuals to 200; (iii) forbids any solicitation to people in general to buy in for any protections of the organization.”

Features

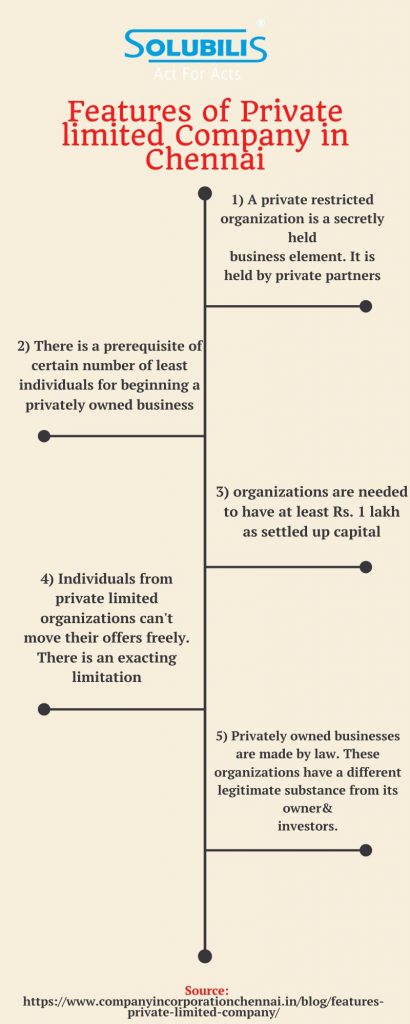

Number of Members

There is a prerequisite of certain number of least individuals for beginning a privately owned business. Additionally, there is a cutoff to the greatest number of individuals in a privately owned business. A privately owned business need to have at least 2 individuals for beginning its business. Nonetheless, it can’t have in excess of 200 individuals, this is as far as possible.

Limited Liability

Individuals from private limited organizations appreciate restricted obligation in the business. The obligation of its organizations has restriction to the quantity of offers held by them. If there should arise an occurrence of misfortunes just investor share in organization resources is at risk for installment.

Minimum Paid-Up Capital

Privately owned businesses require certain measure of least capital for beginning its business. These organizations requires to have at least Rs. 1 lakh as settled up capital. The restriction of settled up capital for these organizations has endorsement now and again.

Limitation on Shares Transferability

Individuals from private limited company can’t move their offers freely. There is an exacting limitation on the adaptability of offers in these organizations. Investors need to examine and take assent of different investors for move of offers.

Private Limited Suffix

It has significant for privately owned businesses to utilize “Private Limited or Pvt. Ltd.” in their name. Privately owned businesses are compulsory necessary to utilize this in their name.

Perpetual Succession

The private limited company continue proceeding for eternity. Its life or coherence has no influence by the existence of its individuals. These organizations are possible by law and have additionally disintegrated by it. Demise, indebtedness or chapter 11 of any of its individuals doesn’t influence the existence of the business. The business appreciates never-ending progression.

Separate Legal Entity

Privately owned businesses are possible by law. These organizations have a different legitimate substance from its owner& investors. It has treatment as a counterfeit individual and behaviors business in its own name. It has its own name, own seal and possesses all property in his own name.

Some Legal documents

Transaction documents

The main transactions that take place include sales, purchases (goods and services) and payroll related transactions. Others include the cost of rent, raising money, paying money, and tax-related costs, but some are included. All of these transactions must be adequately captured by the economic reporting system.

A supporting document will be created to confirm that most transactions have been transacted, while the transaction has taken place and the transaction has an associated value. These documents are important for the financial accountant, who uses the information in the documents as a data source to start measuring and recording transactions.

Partnership agreement

A partnership agreement is an agreement between one or more businesses or individuals who are choosing to run a business together. In general, each member will bring an initial contribution to the business such as capital, intellectual property, real estate or production space.

Before entering into a partnership agreement, you need to discuss some important details with your business partner (s). Here are some examples of information that should be included in your partnership agreement:

Contact information

- The Contact information for the person planning the partnership

- Also the contact information for business only

Business details

- If you have a legal name for the partnership as well as a trade or business name

- A description of what the business does

- From what date will your business be operational?

- How many employees do you expect?

- Expected income

- Expiration date, if applicable

Details of spouse and employees

- Percentage of ownership for each partner

- Partner contributions

- How can a spouse leave the company

- What happens if the spouse dies

- Non-competitive requirements

- Non-partner employee details

Tax liabilities

- Who will be responsible for tax matters

- When your financial year ends

Right to vote

- How voting rights will be shared

- How many votes are needed to make business decisions

Co-founders agreement

The legal document that determines the need for co-founders to work in the organization and with each other is known as the founder’s agreement or co-founder’s agreement. The co-founder agreement sets out the terms and conditions between the founders of start-up regarding the way the business will be run.

The agreement is a written document that acts as a constitution for co-founders if there is a dispute between them in the future it provides the legal remedy and law applicable in case of breach by any person initially established.

Important clauses

- Equity ownership

- Vesting

- Transfer of shares

- Intellectual property

- Confidentiality

- Non-compete clause

- Designation and Employment

- Finances of the start-up

- Removal or exit of the co-founder

- Dispute resolution

Business pitch deck

A pitch deck is usually a 10-20 slide presentation designed to give a brief overview of your company, your business plan, and your initial vision. It also serves many different purposes, from trying to get a meeting with new investors to presenting it on stage, and each of them should follow a different constitution.

Most of them agree on the following outline of the pitch deck:

- Problem

- Solution

- Product

- Market size

- Business model

- Underlying Magic

- Competition

- Better / different

- Marketing plan

- Team slide

- Traction / Mile Stones