Private limited company has handled by small group of people privately. If anyone needs to start a business in India, the first step is to enact the Companies’ Act, 2013. This is to increase the legal presence of the business in India by registering the business with the consent of the applicable provisions of. The business needs to have registration before starting any business. The step taken initially is to choose what type of business anyone wants and how to define for the business among the different types of business structures available in India.

Registration of a private limited company the best known business structure in India. Company registration in India is online and registration of a private limited company requires at least two shareholders and two directors. Private Limited Company Registration in India is the standard for starting a new business. This structure has created under an organized business sector governed by specific laws and provisions. An Indian company has affiliated and registered under the Indian Companies Act, 2013, which has appointed the Ministry of Corporate Affairs as an oversight body.

A private limited company has many characteristics that cover issues such as borrowing money, paying pensions, reporting business accounts, selling business or raising capital.

Benefits of private limited company

Ownership:

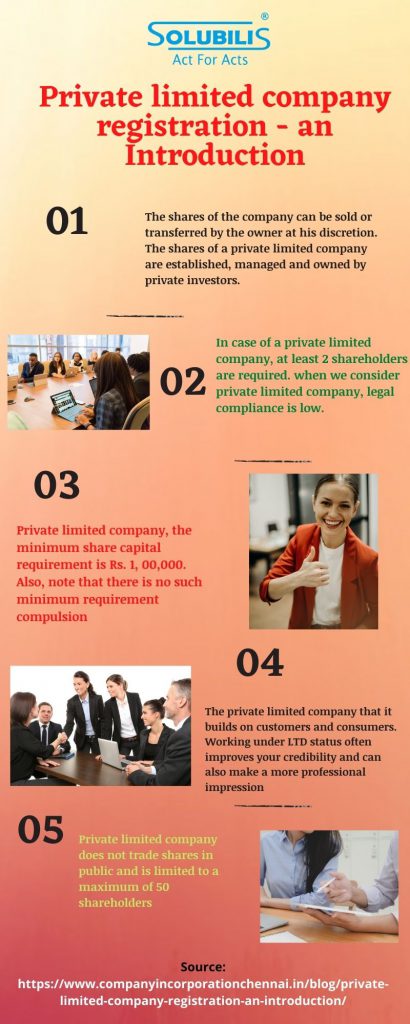

In the case of a public company, proprietary shares have sold to the public on the open market. However, in the case of a private limited company the shares of the company have sold or transferred by the owner at his discretion. The shares of a private limited company have established, managed and owned by private investors. Shares of a private limited company have no place to have sold in open market. Thus, a private limited company has owned by a small number of shareholders which enables less complexity and confusion in decision making and management.

Minimum number of shareholders:

In case of a private limited company, at least 2 shareholders are necessary. However, in the case of a public limited company, at least 7 shareholders are necessary.

Legal compliance:

Legal compliance is an important factor after creating a company. If you are planning to create a public limited company, you should have preparation to follow a long list of compliance after creating a public limited company. However, when we consider private limited company, legal compliance is low.

Management and decision making:

In the case of a private limited company, the small number of shareholders makes it easy to make such a decision. However, in the case of a public limited company, management and decision making is difficult, as a greater number of shares have consulted in case of decision making.

Minimum share capital:

In the case of a public limited company, the investment has higher which is required. The minimum share capital of a public company is 500,000. However, in the case of a private limited company, the minimum share capital requirement is Rs. 1, 00,000. Also, note that there is no such minimum requirement compulsion.

Types of shares in private limited company

Equity shares:

The most common type of share, all equities have considered equal. So if you have equity in a company, your shares include all voting and other rights. In U.S, known as common stock.

Share the equity with the difference voting rights:

Such shares are usually have issued to the founder or CEO so that they have more control over the day-to-day affairs of the company. Google and Facebook are two companies known to issue shares that give certain voting rights to certain sections of investors. However, in India, for the issuance such shares, one must show that someone is capable of distributing dividends for three years.

Preferred shares:

This, as stated, is preferential. The advantage of having preferential shares is that, in case of liquidation of the company, after all the debts of the company have been settled, the preferential shareholders will be paid first. Payments will be made to ordinary shareholders once this is done. These shareholders are also frequently paid by shareholders separately from different equity shareholders.

Sweat equity

Sweat equity is put into the project by unpaid labor employees and cash-strapped entrepreneurs. Mostly real estate investors and the homeowners and can use sweat equity. It is used to do repairs and maintenance instead of paying for conventional labor. In startups with cash, owners and employees accept salaries that are below their market value; which are in exchange for a share of the company.

ESOP

A common problem most entrepreneurs face is how to find ways to motivate their employees in a mutually beneficial way. The most practical solution to this is the Employee Stock Options Plan (ESOP). In which it has used equally by small and large enterprises. It keeps the qualified employees motivated which is helpful for growth in the company. In ESOP companies provide stock ownership to their employees. This has often done without any apparent expense but instead of the work they do. Shares have allotted to employees but had permission only after a pre-determined period. It cannot have the provision to freelancers, promoters, consultants.

Conclusion

One of the major advantages of this structure is the tax efficiency, the private limited company that it builds on customers and consumers. Working under LTD status often improves your credibility and can also make a more professional impression. This can lead to more business and higher profits in the long run.

Many businesses choose to operate as a private limited company. A limited company is a legal entity in itself, as opposed to working as a sole trader. It has a variety of structure and more complex requirements such as different tax, legal obligations. The biggest difference between sole proprietor and incorporating a limited company is that the limited company has a special status in the eyes of the law.

Unlike a publicly Ltd on a stock exchange, where shares have traded, a private Ltd does not trade shares in public; and has limitation to a maximum of 50 shareholders.